Tax-Reduction Strategy Services

Protect yourself and your assets from taxes in retirement.

Your Partner in Retirement Planning

You may stop working, but that doesn’t mean you stop paying taxes. In fact, taxes could be one of the largest expenses you pay in retirement. The good news is you can limit your tax exposure and potentially reduce your bill with forward-thinking planning strategies.

At Trinity Financial Group, we consider taxes in everything we do. From investment strategies to retirement income planning and even to estate planning, taxes can impact every aspect of your financial life.

We develop and implement strategies to help reduce your tax exposure so you can enjoy more of what you love in retirement.

What taxes will you face in retirement?

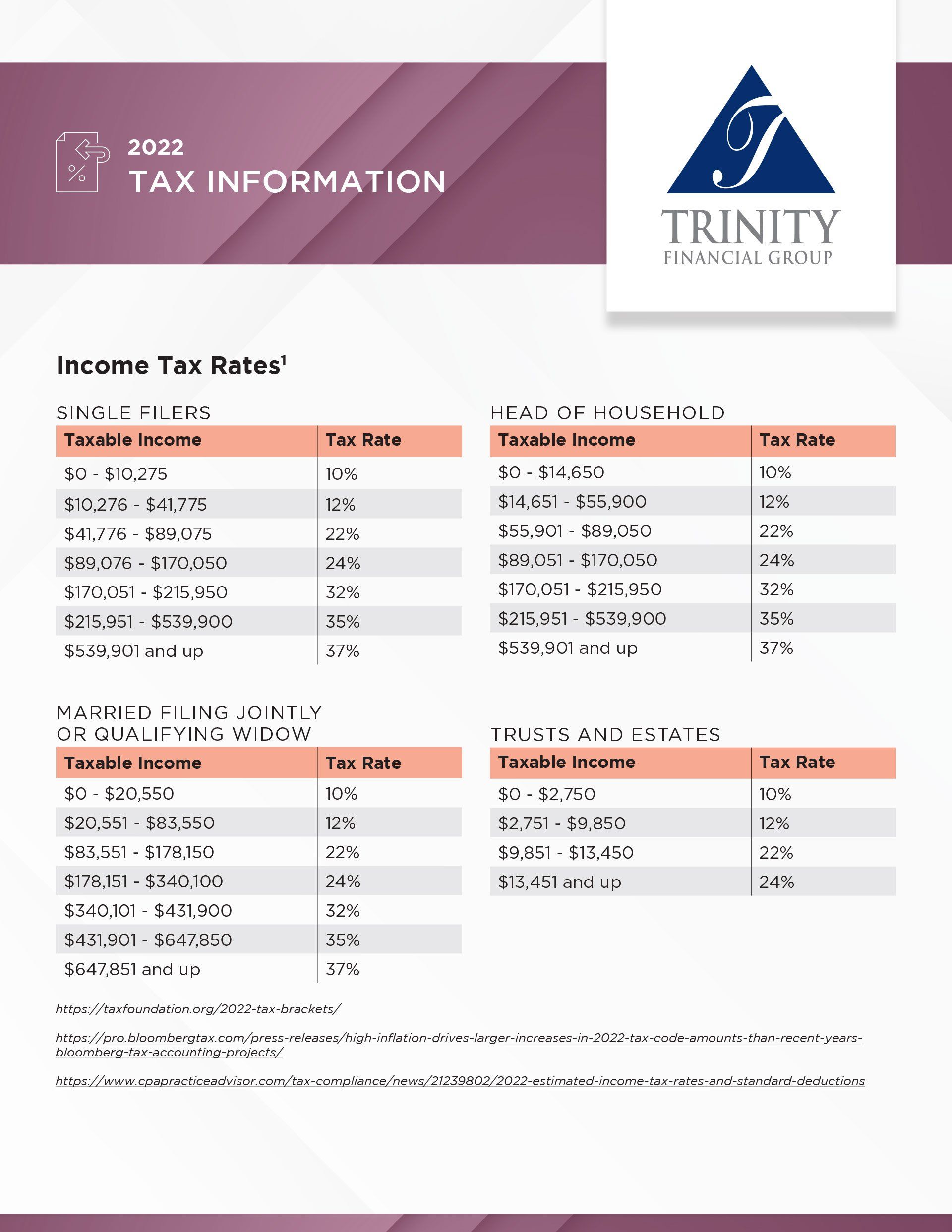

The specific taxes you may face in retirement depend on your situation, but it’s likely that you will continue to pay income taxes after you stop working. Many common sources of retirement income are potentially taxable, including:

- Distributions from retirement accounts like 401k plans, IRAs, profit sharing plans, and more

- Social Security distributions

- Annuity income

- Defined Benefit Pension benefits

- Wages

- Business income

- Rental property income

- And much more

The taxes don’t stop with federal income taxes though. There are other taxes you could face depending on your financial situation and where you live. Some examples include:

- State and local taxes

- Property taxes

- Medicare premiums

- Capital Gains taxes

- Sales tax

- Gift taxes

- Estate taxes

- And more

Every dollar you pay in taxes is a dollar that can’t be used to support your retirement goals. We help you implement strategies that can potentially reduce your tax exposure and maximize your family’s financial wellbeing in retirement and beyond.

Do you have a retirement tax minimization strategy?

Download our complimentary Retirement Taxes Cheat Sheet to learn more about taxes in retirement.

How can you protect yourself from taxes in retirement?

Every client’s situation is unique, which means the strategies we recommend and implement vary from client to client. However, there are some general ideas and strategies that we frequently consider:

What’s your tax minimization strategy?

As the saying goes, taxes is one of only two certainties in life. We can’t eliminate taxes, but we can help you prepare for them. Time is one of your most powerful assets. The sooner you start planning for future taxes, the more options you’ll have available.

Let’s start the conversation today about your tax minimization strategy and your overall financial goals. Schedule a consultation today and let’s start the process.